In our last post we took a fresh look at what we know about Canadians who donate and what motivates their giving. New insights had us also wanting to ensure we started our 2024 planning sessions with a look at the broader Canadian marketplace and consumer trends nonprofits need to consider. Four key trends quickly surfaced, along with the fact that all consumers now demand your business is easy to interact with. This “simple” business fundamental will trigger lower retention rates across all segments.

Key Canadian Consumer Trends

- Reduced Discretionary Income and Rising Costs = Frugal Mindset

- Waning Brand Loyalty and Trust

- Building Local / Community = Stronger Brand Relationships (and Trust)

- Personalization is Preferred

1. Reduced Discretionary Income & Rising Costs = Frugal Mindset

Like consumers, all nonprofits are continuing to struggle with rising costs. The pandemic has impacted the sub-sectors differently with for example, social service agencies experiencing spikes in demand and arts organizations struggling to recover from lengthy closures and worried about whether membership fees or ticket sales will be impacted by reduced consumer spending. Bank of Canada Surveys show most businesses are forecasting weaker sales growth and that most consumers expect high inflation rates will continue for the next 5 years. Stats Canada continues to report that like many countries with growing income inequality / polarization, the lowest wealth-holders are reporting higher levels of household debt and are struggling to meet expenses for transportation, housing, food, and clothing.

- Canadians report they plan to reduce spending in areas like home entertainment, fashion, electronics, health & beauty and home improvement. Globally Euromonitor reports 55% of consumers reduced their food waste in 2022 and 43% reduced their energy consumption, which builds upon environmental and reduced spending trends.

- Perceived inflation rates are highest among younger generations and lower-income households (less than $40,000 CAD). (Statista)

- 86% of consumers indicate special offers, incentives or discounts are important as they are consuming less for economic reasons.

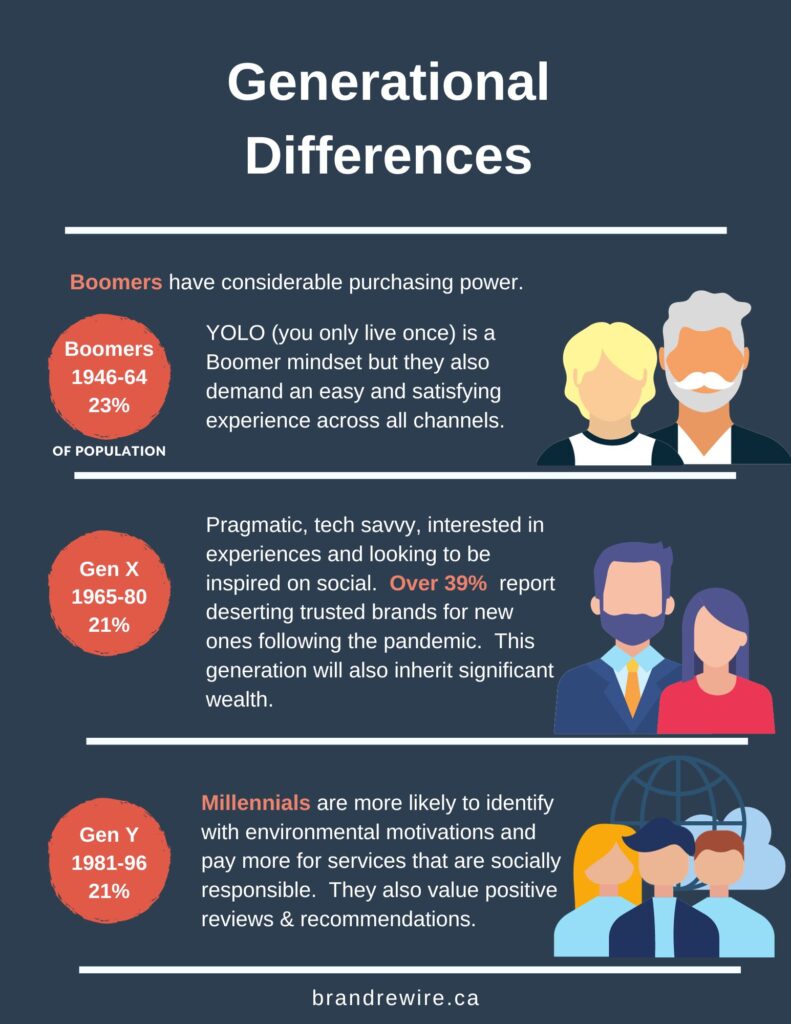

While nonprofits need to consider the generational / lifestage differences that impact discretionary income, it is important to note that newcomers are projected to reach 29 to 34% of the Canadian population by 2041 (Stats Canada). Communication strategies need to consider maintaining existing older Canadian donors, engaging the next generation of younger donors and developing a strategy to cater to this growing new immigrant segment of the market. Canada’s new immigrant population tends to have a higher household income and is more likely to attain higher levels of education.

2. Waning Brand Loyalty and Trust

Consumers want businesses to inspire trust and to be socially and environmentally responsible. As consumers shift their spending habits to align more with their values, their expectations are evolving around diversity and inclusion, environmental protection, and ethical and transparent business / governance practices. While this is opening up new opportunities for businesses to co-create and collaborate on cause-marketing campaigns, it is also becoming more difficult as we saw in earlier posts to retain customers / donors.

Not Easy to Do Business With = Brand Switching

It is important to note that consumers are also expecting convenient, simple end-to-end transaction processes as well. While consumers are now happy to consider other brands due to price, over 60% of consumers report switching brands if they don’t find your business easy to transact with. So while they report an intent to shift to trustworthy brands, convenience and the ability to easily make a donation / transaction is critically important as well.

Communication Essential to Building Brand Trust

As we map out communications plans, teams need to factor in opportunities for third-party endorsement / authentication and that donors / customers now demand not only updates on key financial indicators but also on social and environmental impacts. Canadians with higher levels of education are more likely to align with the good corporate citizen trends, as are groups who are concerned with structural inequity.

- Consistent with donors researching a charity, a 2020 study by Trustpilot found that 89% of consumers worldwide read reviews before purchasing a product/service.

- 56% of Canadians report they have stopped doing business with companies whose practices they don’t agree with.

- 90% report they would stop purchasing a brand if they found out they were using deceptive or irresponsible business practices.

- Over half of Canadians now report a willingness to change consumer brands. This is consistent with global trends that half of consumers are rethinking what’s important in life, and that includes the brands they will purchase.

- And let’s not forget that brand trust must also factor in consumer data and privacy. TFO reports that 2/3 of Canadians now feel more comfortable making online payments through a digital wallet rather than traditional methods due to privacy and fraud concerns. 56% of consumers also report preferring a biometric sensor on their payment methods rather than a traditional pin. Over 75% of newly released mobile devices utilize some form of biometric tech. All businesses will continue to be impacted by technology advancements and changing privacy laws / best-practices.

- 74% of consumers surveyed said they highly value their data privacy and 82% are concerned about how companies are using their personal data.

3. Building Local / Community = Stronger Brand Relationships (and Trust)

“Give where you live” has been an ongoing factor in evaluating donor preferences for years. Following the global pandemic, all consumers are now far more sensitive to supporting local communities.

- Over 80% of Canadians are motivated to donate to contribute to their community (Imagine Canada, 2013) and 1 in 2 donate their time to local nonprofits.

- According to BDC 97% of Canadians now report they would prefer to buy local to support the economy. This is most notable in Quebec and Eastern Canada.

- 72% of Canadians are now reporting they will pay a premium for locally sourced or produced products and 75% will pay more if the company has a reputation for ethical practices.

- A recent Global analysis by OCHA and Ground Truth Solutions demonstrates that there is a strong relationship between trust and programme outcomes.

4. Personalization is Preferred

Personalization is also now a basic business requirement. BDC reported in 2013 that nearly 75% of Canadians wanted personalized services and products and interest in personalization is increasing drastically. In 2022, 62% of consumers surveyed in one study said a brand would lose their loyalty if it did not deliver a personalized experience, up from 45% the previous year.

- 74% of consumers surveyed said they highly value their data privacy and 82% are concerned about how companies are using their personal data.

- 75% of customers now report being annoyed if a website isn’t individualized to their requirements. If you are not individualizing your messaging to consumers, you are well behind the competition.

- Research continues to show personalized eMail increases engagement and can create 6X higher transaction rates. With new technology, personalization has moved far beyond just using a person’s name in messages (historical mail merge techniques).

As we venture further into 2023 and plan for 2024, it’s crucial for businesses to stay abreast of the latest trends shaping the Canadian consumer landscape. As we continue to recover from the pandemic, transitioning smoothly in this evolving landscape demands adaptability and a proactive approach. Understanding these trends will require an understanding of the nuanced changes in consumer behaviour as well as your organizations key analytics and insights. For each of our posts this fall, we’ve included helpful references to enable readers to explore more on how Canadian consumer behaviour trends are impacting nonprofits, businesses and individuals.

Stats Canada Household Debt and Consumer Spending & Other Sources

https://www150.statcan.gc.ca/n1/pub/11-631-x/11-631-x2023003-eng.htm

https://www.statista.com/statistics/1362440/quarterly-inflation-perceptions-canada-by-age

https://www.statista.com/statistics/1319140/changes-to-consumer-spending-due-to-inflation-canada